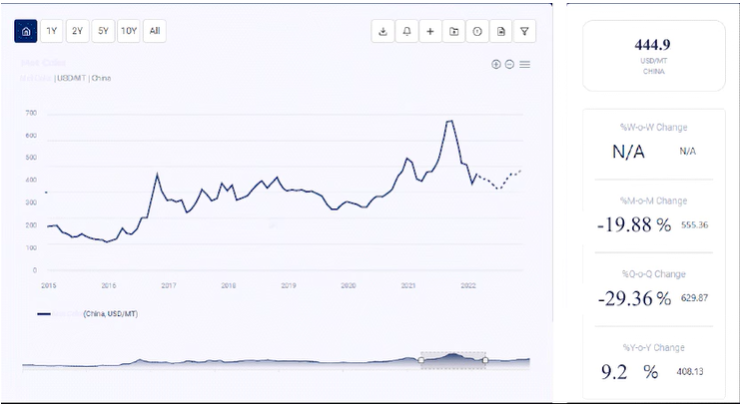

Coking coal, also known as metallurgical coal, is a critical raw material used in the steelmaking process, specifically in the production of coke, which is necessary for the conversion of iron ore into steel in blast furnaces. Understanding the price trend of coking coal is essential for stakeholders in the steel industry, including steelmakers, miners, traders, and investors. In this article, we delve into the factors influencing coking coal price trends and the dynamics shaping the market.

Factors Influencing Coking Coal Price Trends:

-

Steel Demand and Production: The demand for coking coal is closely tied to the global steel industry’s health and steel production levels. Economic factors, infrastructure development projects, construction activity, and manufacturing output influence steel demand, which in turn impacts coking coal consumption. Fluctuations in steel prices and production levels can lead to corresponding changes in coking coal prices.

-

Supply Dynamics: Coking coal supply is influenced by factors such as geological reserves, mining capacity, production costs, and regulatory constraints. Supply disruptions due to mine closures, labor strikes, transportation bottlenecks, or adverse weather conditions can lead to temporary shortages and price spikes in the coking coal market. Conversely, expansions in mining capacity or new mine developments may increase supply and exert downward pressure on prices.

-

Energy Prices: Energy costs, particularly for electricity and diesel fuel, are significant components of coking coal production expenses. Fluctuations in energy prices, driven by factors such as oil prices, supply-demand dynamics, geopolitical tensions, and environmental regulations, impact mining costs and subsequently influence coking coal prices. Rising energy prices can increase production costs and lead to higher coking coal prices.

-

Environmental and Regulatory Factors: Environmental regulations, including emissions standards and carbon pricing mechanisms, can impact the cost of coking coal production. Regulatory requirements aimed at reducing greenhouse gas emissions and promoting clean energy alternatives may increase compliance costs for coal mining operations. Additionally, policies addressing air and water pollution may impose additional environmental compliance costs, influencing coking coal prices.

-

Infrastructure and Logistics: Efficient transportation infrastructure is essential for the timely delivery of coking coal from mines to steel mills and export terminals. Infrastructure constraints, such as insufficient railway capacity, port congestion, or regulatory delays, can disrupt supply chains and increase transportation costs. Improvements in infrastructure, including railway upgrades, port expansions, and streamlined logistics, can enhance supply chain efficiency and mitigate price volatility.

Enquire For Regular Prices: https://www.procurementresource.com/resource-center/coking-coal-price-trends/pricerequest

Market Dynamics and Outlook:

-

Global Steel Market Trends: The health of the global steel industry, driven by economic growth, construction activity, manufacturing output, and infrastructure investments, strongly influences coking coal demand and pricing trends. Trends in steel production capacity, steel prices, and steel consumption patterns in major steel-producing regions such as China, India, Europe, and North America impact coking coal market dynamics.

-

China’s Steel and Coal Policies: China, the world’s largest producer and consumer of steel, plays a significant role in shaping coking coal market trends. Government policies, including steel production restrictions, environmental regulations, import quotas, and coal mine safety measures, can impact coking coal supply and demand dynamics. Changes in China’s steel and coal policies, driven by economic priorities, environmental goals, and energy security concerns, influence global coking coal prices.

-

Trade Dynamics: Coking coal is a globally traded commodity, with major exporting countries including Australia, the United States, Canada, and Russia. Trade dynamics, including import-export volumes, trade agreements, tariffs, and shipping costs, affect coking coal prices. Changes in trade policies, geopolitical tensions, and trade disputes can disrupt supply chains and influence market sentiment, leading to price fluctuations.

-

Technological Developments: Technological advancements in mining techniques, coal processing technologies, and steelmaking processes can impact coking coal production costs and market competitiveness. Innovations such as automation, digitalization, and advanced analytics improve operational efficiency, reduce costs, and enhance productivity in the coal mining sector. Additionally, advancements in clean coal technologies and carbon capture utilization and storage (CCUS) may influence the long-term demand outlook for coking coal.

-

Sustainability and ESG Considerations: Environmental, social, and governance (ESG) factors are increasingly important considerations for investors, companies, and regulators in the mining and steel industries. Sustainable mining practices, emissions reduction initiatives, and commitments to carbon neutrality impact industry stakeholders’ strategies and decisions. ESG considerations, including climate change mitigation efforts, renewable energy investments, and decarbonization targets, may influence coking coal demand and pricing trends in the context of transitioning to a low-carbon economy.

Conclusion

In conclusion, the pricing trends of coking coal are influenced by a complex interplay of factors, including steel demand, supply dynamics, energy prices, environmental regulations, infrastructure constraints, global trade dynamics, technological developments, and sustainability considerations. Understanding these factors and their implications is essential for stakeholders across the coal mining and steel industries to navigate market dynamics, manage risks, and capitalize on opportunities. Moreover, maintaining resilience, adaptability, and sustainability in the face of evolving market conditions is critical for long-term success in the dynamic and competitive coking coal market.